Financial News and Articles

Find practical tips and knowledge here to stay ahead and plan for your financial future.

Unsure of your next move? Schedule a free, 15-minute chat.

Our Latest Articles

Our articles break down complex topics into simple, easy-to-understand advice to help you get better with your money.

Is your business in distress?

Here are eight essential steps to take to deal with the impact of the COVID-19 on your business as recommended by ARITA the peak Insolvency...

JobKeeper Version 2

ATO Guidelines for JobKeeper As we approach the end date for the initial JobKeeper period and transition into the extended JobKeeper Version 2,...

Misuse of Early Super

ATO threatens fines and prosecution for misuse of early super access scheme Members who took money out of their superannuation without meeting the...

Covid-19 – Access Your Super

Steps to take before withdrawing your super early From 20 April 2020, people affected by the COVID-19 pandemic may be eligible to apply to access up...

Boost Cash Flow

BOOSTING CASH FLOW FOR EMPLOYERS (BCF) We have reviewed the recently announced Government stimulus initiatives. The BOOSTING CASH FLOW (BCF)...

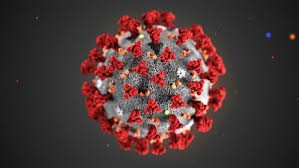

Seven things you need to know about COVID-19

Seven things you need to know about COVID-19 and how it affects you and your business 1. What is COVID-19? COVID-19 is a coronavirus strand and...

Superannuation Budget Highlights 2019

Superannuation • Members of regulated superannuation funds will not have to meet the work test after 1 July 2020 if they are 65 or 66 years of age....

Tax Matters 2019 Budget Edition

Rewarding working Australians The 2019 Federal Budget focuses on rewarding working Australians, with the emphasis on a two-pronged approach for...

STP authorisations

Single Touch Payroll authorisations The ATO has allowed clients to authorise their registered agent to act on their behalf for Single Touch Payroll...

2018 Changes to GST

Changes to GST at settlement forms The Australian Taxation Office (ATO) has announced changes to the way GST is collected at settlement. According...

2018 Highlights

Taxation - building resilience The 2018 Federal Budget is built on the back of a historically strong post-mining boom Australian economy, triggering...

Ready to turn these insights into a personal plan?

Let’s connect for a free, 15-minute chat and get started.